" Why Can Modern Governments Tax So Much? An Agency Model of Firms as Fiscal Intermediaries,"Įconomica, London School of Economics and Political Science, vol. Henrik Jacobsen Kleven & Claus Thustrup Kreiner & Emmanuel Saez, 2016.

McConnell, 2012.ġ006, Economic Growth Center, Yale University.ġ21670, Yale University, Economic Growth Center.ġ7737, National Bureau of Economic Research, Inc.

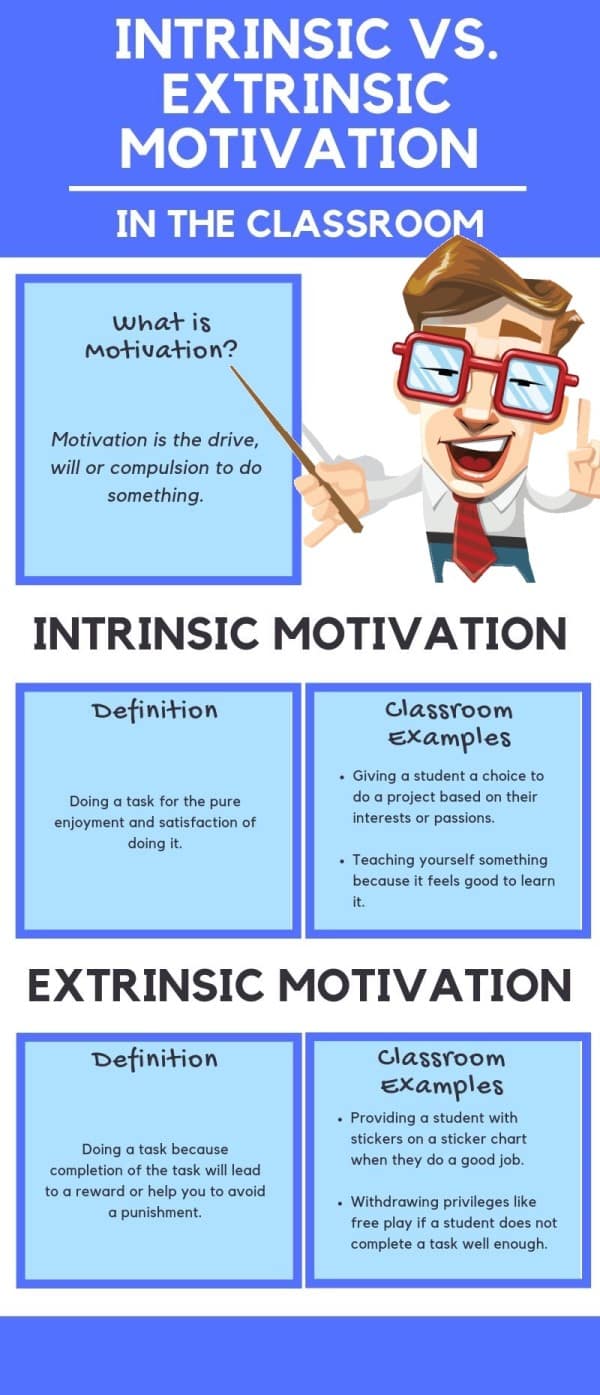

Third, tax salience and deterrence have strong effects on compliance for baseline evaders, but small and insignificant effects for baseline donors. Second, announcing a zero audit probability (the status quo) has a small and insignificant effect on the compliance rate, showing that there is very little misperception on average. Intrinsic motivation is therefore substantial, although the majority behaves as rational, self-interested taxpayers. First, a significant fraction of agents (23%) comply in the zero deterrence baseline where compliance would be zero absent intrinsic motivation, while the remaining 77% evade the tax. Our main empirical findings are the following. This allows us to study if policies aimed at either extrinsic motivation (deterrence) or intrinsic motivation (recognition) have qualitatively different effects on agents who have revealed each of those motivations in the baseline. Starting from the zero deterrence baseline we use a randomized field experiment to inject deterrence or recognition into the system. Since there is zero deterrence in the baseline, baseline compliance provides a direct measure of intrinsically motivated tax compliance. As we show in the paper, tax evaders, compliers, and donors can coexist in the local church tax system and be precisely distinguished from each other. This study uses a unique setting for making progress on this question: the local church tax in Germany. The importance of such intrinsically motivated compliance is hard to study empirically and therefore the least understood. 1998), all of which are non-deterrence driven reasons for compliance.

Is tax compliance driven only by extrinsic motivations such as deterrence and tax policy or is there also a role for intrinsic motivations such as morals, norms and psychology? Agents may comply based on moral sentiments, social norms, guilt and shame (Andreoni et al.

0 kommentar(er)

0 kommentar(er)